What if you are doing your trades wrong? what if there are some mistakes in your trading? Well, you can never be exactly sure that your trades are done in the right way. You may have a good trading brain. But it is not only what it takes to be a good trader. Many traders often cannot reach their goals due to some petty mistakes. These mistakes are pretty common among the traders and you might be making them too. A bit of carefulness can help you to win over the common trading problems.

In today’s discussion, we will be discussing the common trading problems and the ways of solving them.

Table of Contents

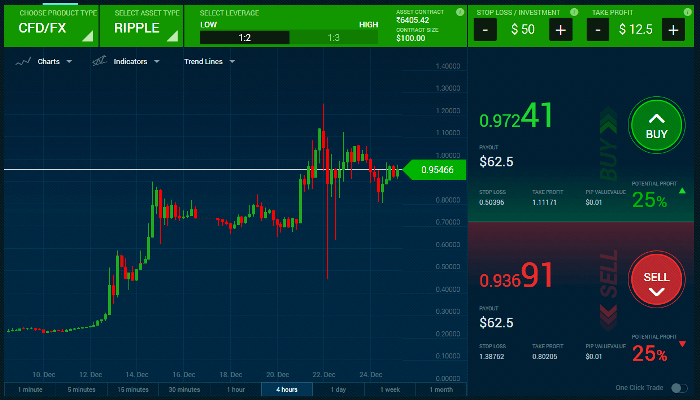

1.Not reading the charts

Many traders often don’t know the importance of trading tools in trading. These tools are necessary to understand the trading market before making deals. Not following the charts is one of the reasons why many traders fail. Again, in Forex trading, not all traders trade professionally and trading is mostly their side jobs. So, they don’t have the time to look at the charts. But if you seriously want to make some money out of this trading business, there is no shortcut to reading the charts. If you are not careful about these charts then you will not be able to know the best tie to enter and exit a trade which can make you potentially lose some money.

2. Improper trade execution

A trader may have prepared so hard for a trade. Usually smart UK traders analyzed all the data and studied the market to know the best opportunity for him to make a trade. But all his works will go in vain if he doesn’t know how to execute his trades properly. In trading, time frames are of huge importance and one should always remain careful to find the most suitable time for him to execute his trades. if a trader buys shares at a higher price and sells them at a lower price, his selling price would become higher than the cost price. As a result, he will face a loss. In this situation, we can say that he lacked executive management. For this reason, one should remain vigilant when it comes to trade execution. And always chose great broker like Saxo markets so that you don’t have to deal with bad trading environment.

3. Not having a money management

When a trader does not have proper money management, he cannot keep a record of where his money is earned and spent. When a person has more expenditure than earning, he suffers from debt. Excessive debt can make a person penniless. That’s why it is important to manage your capital when you trade. If you take on bigger trades than you can handle, the risk of losing also becomes bigger. And but many traders often make this mistake and lose their investment capital. For this reason, it is necessary to find out how much you can handle before you decide to make a deal. Sometimes it is for the best that you let go of an opportunity to save your investment.

4. Half-hearted trading

In this field, we are aware that many traders are not trading on professional trading. They are here only for easy money. But, still, you are investing your capital. If you don’t pay proper attention you can lose that investment. For example, let’s say, you have made a trade with $100 as an investment. But due to your insincerity, you failed the trade and now you are left with $96 for a loss of 6%. So, in this case, rather than having a profit, you faced a loss with your investment. That’s why, when you are trading, it doesn’t matter whether you are a professional or not. Make sure that you put your 100% to make a win.

Humans are to make mistakes and that is natural. But you should also remind yourself to learn from your previous mistakes and not to repeat them.

I am an Ambitious girl with a special interest in writing and sharing my knowledge. I love to hangout with nature and learn from it. My words will display the power of nature to the best as I love to write about the environment.